![]()

Ethereum price started a decent upside recovery against the US Dollar and bitcoin. ETH/USD could gain momentum once there is a break above the $121-122 resistance zone.

Ethereum Price Analysis

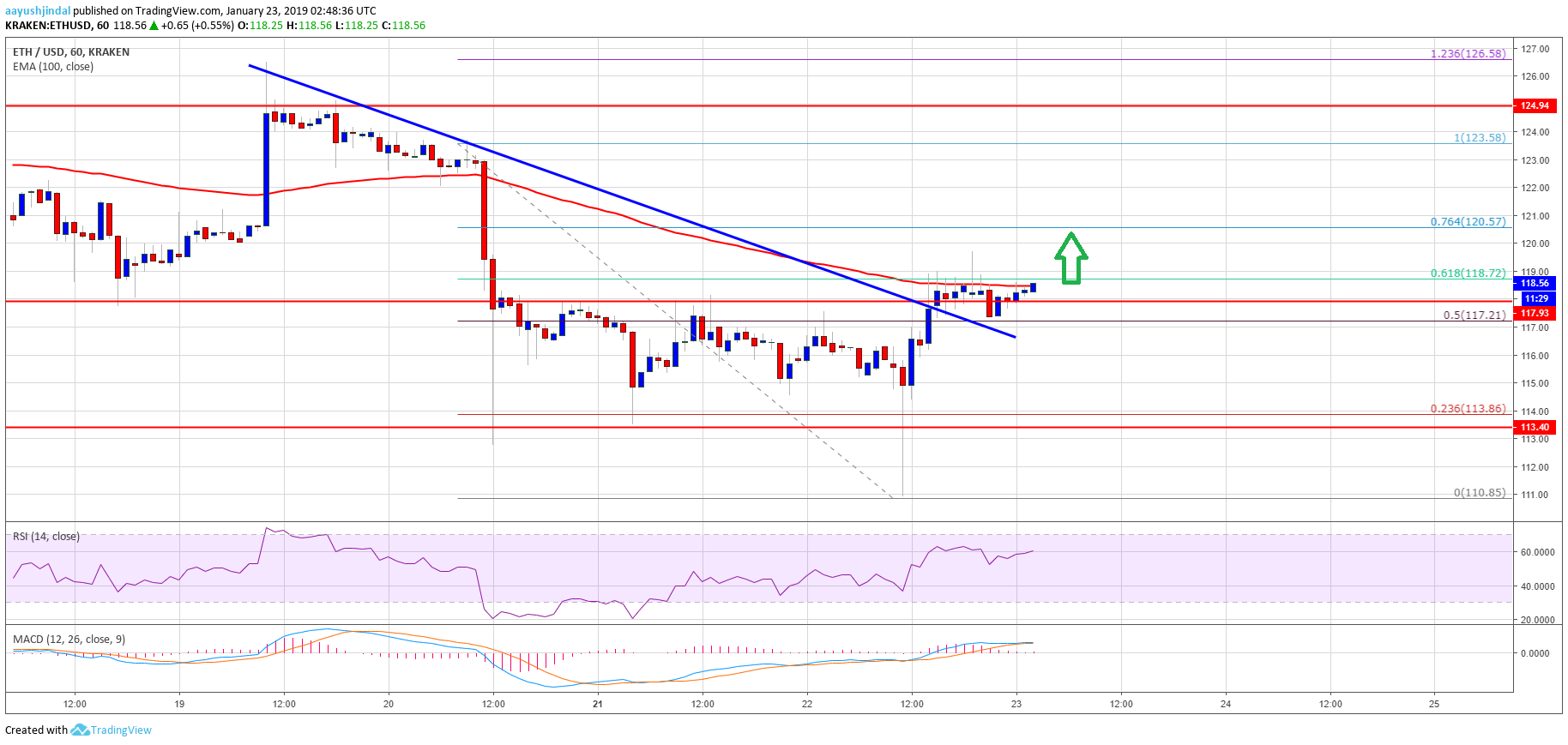

Recently, there was a downside extension below the $114 support area in ETH price against the US Dollar. The ETH/USD pair dipped below the $112 level and tested the $110-111 support area. However, buyers protected the $110-111 support area and later the price bounced back sharply. It traded above the $112, $114 and $116 resistance levels. There was also a break above the 50% Fib retracement level of the recent decline from the $124 high to $111 swing low.

More importantly, this week’s followed key bearish trend line was breached with resistance at $118 on the hourly chart of ETH/USD. The pair spiked above the $118 level and it is currently consolidating gains. Besides, the 100 hourly simple moving average is acting as a resistance near the $119-120 zone. The 61.8% Fib retracement level of the recent decline from the $124 high to $111 swing low is also near $119. Therefore, a proper break above the $119, $120 and $122 resistance levels could push the price further higher. The next important resistance is at $125, where sellers may emerge.

Looking at the chart, ETH price clearly bounced back nicely from the $110-111 support area. However, it must surpass the $119, $120 and $122 resistance levels to remain in a positive zone. If not, the price is likely to trim recent gains and trade back towards the $114 support level.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly moving back in the bearish zone, with no major negative signs.

Hourly RSI – The RSI for ETH/USD is currently placed well above the 50 and 55 levels.

Major Support Level – $114

Major Resistance Level – $120

You must be logged in to post a comment.

Copyright © 2023 iCryptome.com

- Planet TV Studios Presents Episode on Jelurida Swiss on New Frontiers in Blockchain

- Bitcoin Investor Lost Life Savings When QuadrigaCX Didn’t Issue $422,000 Withdrawal

- Torekko Launched First NFTs Collection Give Away Via Airdrop

- Fundamental Analyst: 90% of Smaller Crypto Projects Will Result in Complete Loss

- Explained: this is why traffic lights are green, red and yellow