Contents

Tezos (XTZ) has been the best performer of the past seven days, rising about 43% during the period. It received a boost on the news of its listing on the crypto exchange OKEx.

Another positive news was that Coinbase introduced staking rewards for all Tezos holders, enabling them to earn about 5% annually. After the recent rally, is it a good time to book profits or can the move up extend further?

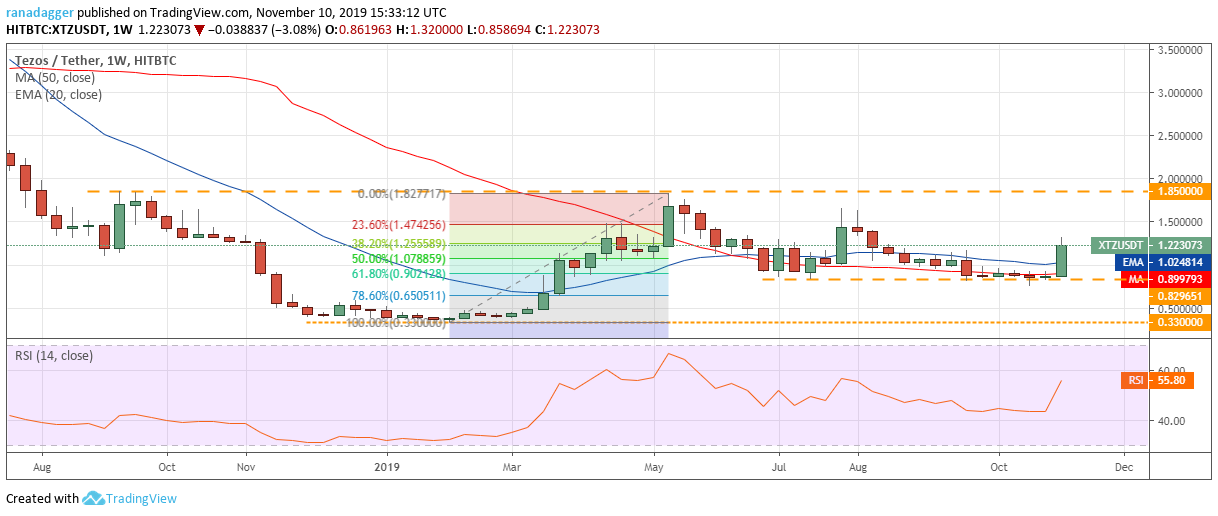

XTZ/USDT weekly chart. Source: Tradingview

The bulls have held the support at $0.829651 for the past few months. This indicates that buyers have been eyeing dips down to this support level to accumulate. The XTZ/USD pair has surged this week and has risen above both moving averages. It can now move up to $1.85. The pair has been pushed back down from this resistance on two previous occasions, hence, a breakout would be a significant event.

On a close above $1.85, a rally to $2.87 and above it to $3.37 is likely. Therefore, traders can buy on dips close to $1.1 levels. Our bullish view will be invalidated if the price turns down and slips below the recent low of $0.75.

Cosmos (ATOM) has been gradually moving higher for the past few days. It has risen by about 24% in the past seven days and is the second-best performer. Can it continue its up move or has it run its course? Let’s analyze its chart.

ATOM/USD weekly chart. Source: Tradingview

The ATOM/USD pair has found support close to $2 levels thrice in the past few months. This shows that bulls have been buying on dips to the support levels. With the rally this week, the price has scaled above the overhead resistance at $3.6043, thus completing a triple bottom formation.

It now has a minimum target objective of $5.2985. If the bulls push the price above this level, a rise to $7 is possible. Therefore, traders can buy on a close (UTC time) above $3.6043 and keep a stop loss of $2.90. Contrary to our assumption, if the price turns around from the current levels and plummets below $3.6043, it will suggest a lack of demand at higher levels.

Stellar (XLM) surged on the news that the Stellar Development Foundation (SDF) had burned over 55 billion of the 85 billion tokens that were set aside for SDF operations, giveaway programs and partnership programs.

The foundation said that the burning was done because it wanted to be leaner and more efficient. After its 12% rally, can it rise further in the next few days or will the price dip due to profit booking? Let’s study the chart.

XLM/USDT weekly chart. Source: Tradingview

The XLM/USD pair is facing selling at the overhead resistance of $0.088708. With the rally this week, the price has risen above the previous low of $0.072545. This shows that the markets have rejected the lower levels. Both moving averages are flattening out and the RSI has risen to just below 50 levels, which shows that the sellers are losing their grip.

If the bulls can defend the support at $0.072545 during the next dip, it will be a positive sign. On the upside, the pair will pick up momentum on a breakout of $0.088708 and the 50-week SMA. Above the 50-day SMA, a rally to $0.145 will be on the cards.

Therefore, traders can initiate long positions on a close (UTC time) above the 50-week SMA and keep a stop loss of $0.067. Our bullish view will be negated if the price turns down from $0.088708 and sustains below $0.072545.

Litecoin (LTC) has been attempting to form a bottom in the past few days. It extended its up move with an 8% rally in the past seven days. What are the critical levels to watch out for and when does it start a new uptrend?

LTC/USDT weekly chart. Source: Tradingview

The LTC/USD pair has broken out of the downtrend line and is attempting a recovery. If it sustains above $62.0764, it will suggest that the lower levels are attracting buyers. There is a minor resistance at the moving averages above which a move to $80.2731 will be on the cards. The flattening moving averages and the RSI moving up slowly suggests that the bulls are making a comeback.

Though positive, we do not find a reliable buy setup at the current levels, hence, we are not recommending to trade it. Our bullish view will be invalidated if the pair turns down and plunges below the recent lows of $47.1851.

EOS rounded up the top five crypto performers of the past seven days with a rally of about 8%. There have been complaints of congestion in the network but it has not affected its price. Has it bottomed out? Let’s find out.

EOS/USD weekly chart. Source: Tradingview

The EOS/USD pair has risen close to the moving averages, which are likely to act as minor resistance. If the bulls can push the price above this resistance, a move to $4.8719 is likely. The flattening moving averages and RSI just below the center indicate that the selling pressure has reduced.

Contrary to our assumption, if the pair turns down from the moving averages and plummets below the recent lows of $2.4001, it can retest the yearly low. However, we give it a low probability of occurring. We do not find a trade setup that offers a good risk to reward ratio at the current levels, hence, we are not recommending taking a long position in it.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

Copyright © 2023 iCryptome.com

- Bitcoin’s defeat of the narrative and the coming on the heels of Etherium

- Traders Bet 1 BTC on Bitcoin Plunging to $1,500 Before Rising to $6,500

- How to select a trusted crypto savings platform

- InComm Launches Go Studio, an Emerging Technologies Incubator

- Binance CEO Lauds Jack Dorsey’s Pro Bitcoin Comments On Joe Rogan